A new car purchase is a significant step toward autonomy and necessitates some degree of financial stability. Your choices will impact your financial future when selecting your new car, which goes much further than color and style. Before making a choice, it is a good idea to do your studies and learn about all of your options. You will have to choose whether to finance your auto loan at a low-interest rate or with an auto rebate. Thus, we have made this post on a cashback or Low-Interest calculator to aid you.

Cash-back is essentially money you get back from the automaker as a reward for making the purchase. You may finance your new car with low-interest financing, resulting in fewer monthly bills.

As I objected to a lower balance after the rebate, whether it is preferable to owe less with massive interest or more with negative rates is the decision we are attempting to make here. Come along as we highlight this.

What is Cash Back or Low-Interest Calculator?

You may use the cash back or Low-Interest Calculator to see if conventional dealer-based financing plus an operator’s rebate the most affordable option for you is. Knowing if borrowing money from the outside with a cheaper interest rate will save you money over the long term can also is helpful.

Simply enter the necessary loan and car data, and the calculator will provide a clear conclusion to assist you in making the best decision for your specific circumstances. You’ll need relevant knowledge, such as the car’s price, the various interest rates, and the rebate value.

How to Use Cashback or Low-Interest Calculator

You can use this cashback or Low-Interest Calculator through the following steps:

- Step 1: Enter your Cash Back Amount

- Step 2: Enter your Interest Rate (High)

- Step 3: Enter your Interest Rate (Low)

- Step 4: Input your Auto Price

- Step 5: Enter your Loan Term

- Step 6: Enter your Down Payment

- Step 7: Enter your Trade-in Value

- Step 8: Input your state

- Step 9: Enter your Sale Tax

- Step 10: Enter your title, registration, and other fees

- Step 11: Input if you want to include TT&L Fees in the loan

- Step 12: Click on calculate, and your cash Back or Low-Interest Results will be displayed.

- Step 13: Click on reset if you desire to calculate with new values

Cashback or Low-Interest Calculator

sHow do you Calculate Cash Back Interest?

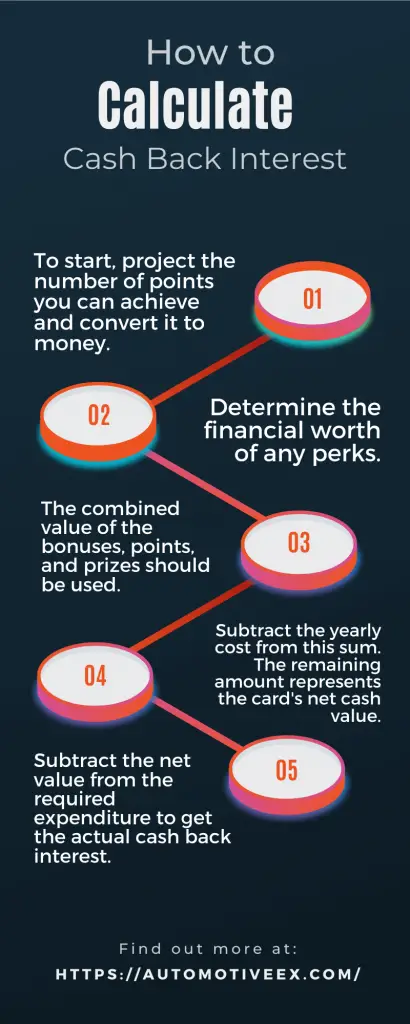

The process for calculating the actual cash-back interest involves a few stages. Before the annual fee is charged, you must ascertain the rewards worth the credit card. After that, do the following:

- To start, project the number of points you can achieve and convert it to money.

- Determine the financial worth of any perks.

- The combined value of the bonuses, points, and prizes should be used.

- Subtract the yearly cost from this sum. The remaining amount represents the card’s net cash value.

- Subtract the net value from the required expenditure to get the actual cash back interest.

Rebate vs. Lower Interest: Which Car Incentive is Right for You?

You may save money on a vehicle purchase with a cash rebate and 0% credit, but they exist separately. A cash rebate is cash the automobile buyer receives in return for buying a car. Either way, a vehicle loan with a 0 percent APR has no fees or charges.

You will need to choose since most automakers regrettably forbid customers from combining both offers. Think about which would help your finances the most when deciding between rebates and 0% financing. The key stages are as follows:

- Verify your eligibility for a rebate or low-interest financing.

- Determine how much is covered by the refund or reduced interest.

- Determine the cost of each choice.

Furthermore, the following table on rebate vs. lower interest will aid you immensely.

| Rebate | Lower interest |

| Useful as a down payment. Cash rebates, as was already mentioned, may be used for your deposit to reduce the total amount of your vehicle loan. | It isn’t quite useful as a down payment. Also, it is only accessible for certain automobiles. You may not be able to get the automobile you desire with this unique financing package since zero percent rates are often only available on a small selection of models. |

| May provide more savings than a 0% deal. In certain circumstances, a cash-back program might result in more financial savings than a 0% vehicle loan alternative. | It May cost more money. Since 0% financing is only available for new vehicles, you would likely spend more for a new vehicle than you would for a used vehicle with a higher APR. |

| Possibility of low rates. Auto loan rates for those with good to exceptional credit are presently low, albeit they may not be 0%. If you choose a rebate, the bulk of your monthly premium will still be applied to the principle. | High rates. Even a credit with no interest might still be expensive if you loan too much. Ensure you have a sizable down payment to help offset the increased new automobile purchasing price. |

| A rebate usually entails a higher monthly obligation. | Reduced monthly obligations. Depending on how long the loan is, your monthly payment can be cheaper than it would be if you chose the cash rebate choice since you wouldn’t have to pay interest. |

| With a rebate, your payback is usually slower. | More rapid payback. Since your amount payable is applied just to the principle and not interest, you might pay off the loan faster by paying more than the bare level each month. |

Which Credit Card is better for me? Cash-Back or Low-Interest

There are several things to consider when choosing between Cash-Back and Low-Interest credit cards. Cash back rewards on credit cards are incentives given to cardholders who make purchases using their cards. Dollars or points may be used as cash back incentives, often redeemed points on a website run by the card issuer.

Additionally, they may assist you in streamlining your money, earning points for your purchases, and using other benefits that debit cards do not provide. A cash-back card is also a smart choice for a first rewards credit card since cash-back incentives are often simpler to comprehend than travel rewards.

On the other hand, if you have a low-interest credit card, your interest rate will be between 10% and 15%. These credit cards often lack any kind of rewards program. Additionally, they work best for those who must carry a balance from month to month.

Remember that some credit cards with low-interest rates include annual fees, which might make the reduced interest rate ineffective. Moreover, not all of the various purchases you make with the card may be associated with the reduced interest rate.

Overall, there are several advantages and disadvantages associated with both Cash-back and Low-Interest credit cards. Consider these benefits and drawbacks before applying for any of the cards.

Cash-Back Credit Card Pros and Cons

A. Advantages of Cash-Back Credit Cards

Rewards in cash: Although each cash-back credit card has a unique earning structure, they all provide the same simple, user-friendly advantage. For every dollar you spend, you will get cashback. Some credit cards provide flat-rate rewards, like 1.5 percent back on all transactions. Others, like Chase Freedom, provide greater cash back percentages on specific transactions. This includes prices for food or petrol, which either don’t change or do every three months.

Most of the best cash-back credit cards available don’t have annual fees. This implies you won’t give up part of your benefits to pay a charge. Even if you choose to use another card as your primary method of payment in the future, you may still keep the current one open and fee-free. This is beneficial since it might raise your credit score to have a longer credit history.

Some credit cards that provide cash back do have a yearly fee. If you decide to use one of them, be sure the benefits you get will outweigh the cost.

Some companies offer 0% APR: For a brief period, several cash-back credit cards offer 0% APR on transactions or debt transfers. This will allow you to pay off a large purchase or current debt without incurring interest charges.

B. The Drawbacks of Cash-Back Credit Cards

Continuously high APR: The 0% APR deal on the cash-back card you select won’t last indefinitely. The typical APR for credit cards is a little over 20%. Additionally, many cash-back credit cards have higher fees. Creditworthiness will determine your continued APR. As a result, if your credit is less than stellar, you will be given an APR at the upper end of the card’s spectrum.

You might be better off forgoing incentives and seeking a card with a low continuing APR if you don’t believe you can clear off your debt in full each month.

Foreign exchange charges: Foreign trading fees are more likely to be waived by travel-related credit cards. On either hand, cash-back credit cards sometimes charge an additional 3 percent for transactions made outside the country.

The Cash-Back Credit Card Pros and Cons can also be seen in the table below;

| Pros | Cons |

| Simple cash-back procedures exist. | Comparatively low overall value to awards for the trip |

| No credit card company may reduce cash back. | Bonus rewards divisions may have enrollment restrictions and earning limitations. |

| Bonus offers at sign-up are typical with cash back credit cards. | Rewards that have expired because to account cancellation, late payments, or unavailability |

| There are several cash-back credit cards without annual fees. | You could be compelled to spend more than you can manage to maximise your incentives or sign-up bonuses. |

| Numerous cash-back credit cards offer 0% introductory APR promotions. | Redeeming your awards is necessary to save cash, and certain redemption methods result in a lower value for your points. |

| You get more than 1% of everything back. | |

| These benefits may get redeemed for things like trip reservations, statement credits, and credits for online shopping, all of which can save you money. | |

| You may select from various reductions or cash back depending on your buys if you buy wisely. | |

| If you wish to challenge a charge or return a faulty item, your cash-back credit card might be able to assist. |

Low-Interest Credit Cards: Pros and Cons

Pros of credit cards with low-interest rates

Reduced interest fees, Of course, saving money on monthly interest payments is the main advantage of having a credit card with a low-interest rate. We advise against carrying a load on your credit card per month, but we also recognize that there are situations when it is totally necessary.

You should certainly check into the low-interest credit card choices accessible to you if you’re presently going through a difficult time or you have no choice but to maintain a debt on your credit card.

You might save up to 50% on interest payments each month if you can be approved for a credit card with a 10% interest rate.

The Possibility of Lower Annual Fees: Some low-interest credit cards feature annual fees of 0 dollars, while others do not. If a low-interest credit card does include an annual fee, it’s often less than $50. If you now use a credit card with a high annual fee, switching to one with a reduced annual fee and a low-interest rate might help you save a lot of cash.

Cons of a Low-Interest Credit Card

Confined reward schemes: An average credit card or a vacation credit card may provide a reward system that is more comprehensive than the one that comes with a low-interest credit card. The primary advantage of one of these cards is the low-interest rate you are receiving.

The trap of low-interest rates: A low-interest rate is a fantastic perk that may work in your favor. Sadly, it is incredibly simple to be caught in the low-interest rate trap. If your quarterly interest rates are so low and you have no compelling reason to make a payment on your debt, you might get too comfortable.

The Low-Interest credit cards’ Pros and Cons can also be seen in the table below.

| Pros | Cons |

| No interest during a certain period | The APR is not permanent. |

| Ideal for substantial transactions | Transfers of balances are not always incorporated. |

| Beneficial for reducing debt with high interest | Still, there is a balance transfer cost. |

| Avoid paying interest | Your credit score may momentarily suffer if you get new credit cards. |

| Reduce your monthly obligations | Zero-interest deals can encourage complacency |

| Enjoy benefits and prizes when you spend | |

| Spend less on interest charges | |

| Boost your credit rating | |

| Aids in clearing existing credit card debt | |

| Lower yearly costs | |

| Acceptable standards for credit scores | |

| Travel protection |

Frequently Asked Questions

How do you calculate monthly car payments?

Divide the entire loan and accrued interest by the repayment period to get your monthly auto loan repayment by hand. You have this many months to pay back the debt.

How Can I Make Sure My Credit Score is high enough?

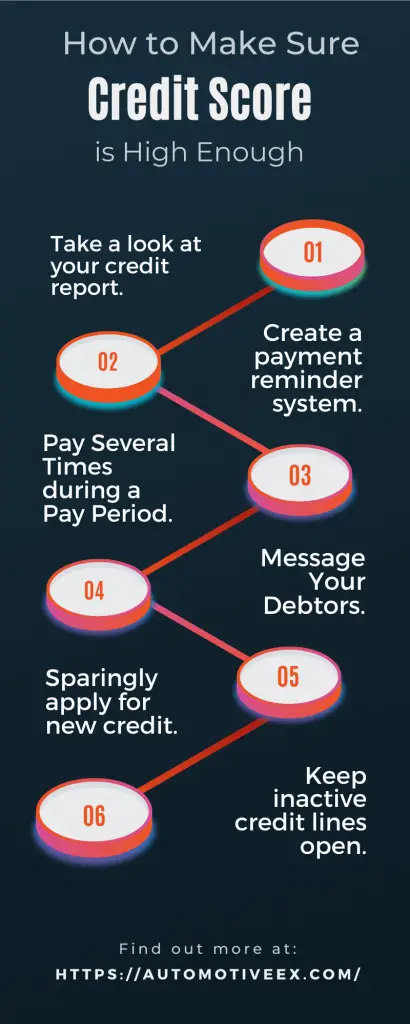

The following methods can help you ensure that your credit score is adequate:

- Take a look at your credit report.

- Create a payment reminder system.

- Pay Several Times during a Pay Period.

- Message Your Debtors.

- Sparingly apply for new credit.

- Keep inactive credit lines open.

Should You Take A Rebate Or 0 Percent Financing?

Depending on what you need right now, your new car’s down cost may be covered by a rebate. However, you may be able to secure a car loan with 0% financing and reduced repayments.

How to choose between 0 percent financing and a rebate

The ideal solution for you will rely on your financial situation and overarching goals if you want to select between rebates and 0% credit.

- Ascertain your eligibility for financing at 0% interest.

- Discover the rebate’s coverage amount.

- Determine the costs of each choice.

Should I Choose a Low Rate or Cash Back?

A cash-back is usually a preferable option if you want to have the lowest minimum repayments possible. The total amount you pay, however, might vary depending on several factors, including the amount of cash you put down, the vehicle’s overall appraised value, the amount of your value-added tax, and the duration of the loan.

Is cash back better than low APR?

Accepting cash is often the preferable choice if you have significant trade and won’t need to borrow a lot of money to purchase your car.

Is it better to take a rebate or lower the interest rate?

A refund will reduce your vehicle loan debt, and your monthly payment will be reduced by low-interest financing. The most advantageous choice is determined by the cost of the car, the extent of the rebate, and the borrowing interest rates.

Is it smart to do a 72-month car loan?

You can get a vehicle loan for 72 months, but you should try to steer clear of loans longer than 60 months as much as possible. Loans for 72 months sometimes have high-interest rates that might cause you to owe more money than your automobile is worth.

Is 0 for 72 months a good deal?

To prevent financial instability, it’s a good idea to make a down payment of at least 20% on a car. If the term is too lengthy, 0% financing may not be the best option. The typical length of a vehicle loan is three to five years. These agreements may sometimes last for six or 72 months.

What is APR cash when buying a car?

The entire revenue level paid over a year to finance a car is known as the annual fee.

What is a cash rebate?

A cash Rebate is the sum of money given back to clients who purchase goods from merchants within a certain time frame. Dealers may eliminate inventory using the rebate without lowering the list price.

What does a low-interest rate mean to the purchaser of a car?

A lower interest rate often translates into smaller and less frequent automobile payments. Your credit rating, down payment, and loan length are a few variables that might affect your interest rate.

Is 5% cash back good?

A card that offers 5% cash back might be a real value if you want to optimize your rewards. They often don’t charge an annual fee and have normal interest rates. These shifting category cards, meanwhile, aren’t for everyone. It might take a lot of effort to minimize consumption, and many individuals don’t want the inconvenience.

When should I pay my credit card to avoid interest?

One of the greatest strategies to keep from accruing credit card debt is paying your monthly bill amounts full during your grace period. You may use your credit card to make purchases without incurring interest as long as you pay off your debt before the end of your grace period.

Do you pay interest on a credit card if you pay it off every month?

For instance, the interest rate on your credit card won’t matter if you pay off the whole sum each month. No matter how low or high the rate; it will never be a factor.

How do you choose between a low-interest rate and a rebate?

A refund will reduce your vehicle loan debt, and your monthly payment will be reduced by low-interest financing. The most advantageous choice is determined by the cost of the car, the extent of the rebate, and the financing interest rates.

Which Student Loan has the highest interest rate?

With interest rates ranging from 3.73 percent to 6.28 percent, federal loans make up around 90% of student loan debt. On the other hand, the typical interest rates for private student loans may vary from 2.99 to 12.99 percent fixed and from 0.94 to 11.98 percent variable.

How does 2% cash back work?

If your cash back credit card, for instance, gives 2% cash back on purchases, you will get $2 in rewards for every $100 you spend.

What does 3 percent cash back mean?

On specific kinds of transactions, certain credit cards offer larger cash-back rates. Because you get a larger percentage of cash back, these cards are known as bonus category cash back cards on expenditures in certain categories, including travel or grocery, this often means a surcharge if over 3 percent.

What does cashback mean when buying a car?

Cash back at a dealership is a discount provided by the maker of the vehicle you want to purchase. The dealership you are dealing with does not provide this cash back rebate. Manufacturers do, however, permit dealerships to promote these incentives.

What are rebates on loans?

A brokerage will compensate a client that loans stock to short-sellers who need to borrow shares as cash collateral a stock loan rebate. A loan fee is assessed to the shareholder borrowing shares whenever security is lent out. This also includes any loan-related interest that is owed.

References

- https://www.regions.com/insights/personal/Auto-Calculators/should-i-choose-low-rate-or-cash-back

- https://www.car-buying-strategies.com/rebate-vs-low-interest.html

I am an Automotive specialist. I graduated from Michigan with Bachelor in Automotive Engineering and Management. Also, I hold degrees in Electrical and Automation Engineering (BEng), Automatic and Industrial Electronic Engineering, and Automotive Technology. I have worked at General Motors Company for over five years as the Marketing Operations Production Coordinator. Now, I own my garage in Miami, Florida. I love cars and love to share everything about them with my readers. I am the founder of the Automotiveex blog, where I share everything about automotive, like car news, car mechanical issues, and anything else that comes up in my blog posts.